duluth mn restaurant sales tax

Sales are reported and tax collected is remitted to the City of Duluth Treasurer. The Duluth City Council took its first steps Monday night toward imposing a half-percent tax on hotel stays and sales of food and drinks served at city restaurants and bars.

Duluth Mn Restaurant Sales Tax City And State

Duluth MN Sales Tax Rate.

. The 8875 sales tax rate in Duluth consists of 6875 Minnesota state sales tax 15 Duluth tax and 05 Special tax. The average cumulative sales tax rate in Duluth Minnesota is 883. A business needs to obtain a Minnesota tax identification number a seven digit number assigned by the Minnesota Department of Revenue if it is required to file information.

This is the total of state county and city sales tax rates. The Minnesota sales tax rate is currently. You owe use tax when Minnesota City of Duluth sales taxes are not charged on taxable items you buy whether you buy them in Minnesota or outside the state.

Lowest sales tax 45 highest sales tax 8875 minnesota sales tax. Duluth is located within St. You owe use tax when minnesota city of duluth sales taxes are not charged on taxable items you buy.

Authorities said Osaka Sushi. This includes bars restaurants food trucks and retailers or others who sell. A Duluth restaurant and its owners have pleaded guilty to tax fraud and will be required to pay nearly 300000 in uncollected sales taxes.

You can print a 8875 sales tax table. Most food and drink sold by a food or bar establishment is taxable unless a specific exemption applies. The current total local sales tax rate in Duluth MN is 8875.

This includes the sales tax rates on the state county city and special levels. There is no applicable county tax. The minimum combined 2022 sales tax rate for Duluth Minnesota is.

The Duluth Minnesota sales tax is 838 consisting of 688 Minnesota state sales tax and 150 Duluth local sales taxesThe local sales tax consists of a 100 city sales tax and a. Find out with a business license compliance package or upgrade for professional help. If the items you are buying.

The December 2020 total local sales tax rate was also 8875. The results do not include special local taxessuch as admissions. Do you need to submit a Meals Tax Restaurant Tax in Duluth Township of MN.

Authorities said Osaka Sushi. You owe use tax when minnesota city of duluth sales taxes are not charged on taxable items you buy. Use this calculator to find the general state and local sales tax rate for any location in Minnesota.

Sales Tax Rate Calculator. Food and Beverage establishments must collect 225 for the Food and Beverage Tax. Lowest sales tax 45 highest sales tax 8875 minnesota sales tax.

A Duluth restaurant and its owners have pleaded guilty to tax fraud and will be required to pay nearly 300000 in uncollected sales taxes.

Duluth Minnesota Mn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Huge Vintage Restaurant Menu Somebody S House Bloomington Duluth Minnesota Mn 1842540064

Duluth Mn Restaurant Sales Tax City And State

Duluth Warehouse Opening Costco

Duluth Grill On Diners Drive Ins And Dives Perfect Duluth Day

Restaurant Equipment Auction Nordic Auction Duluth Mn

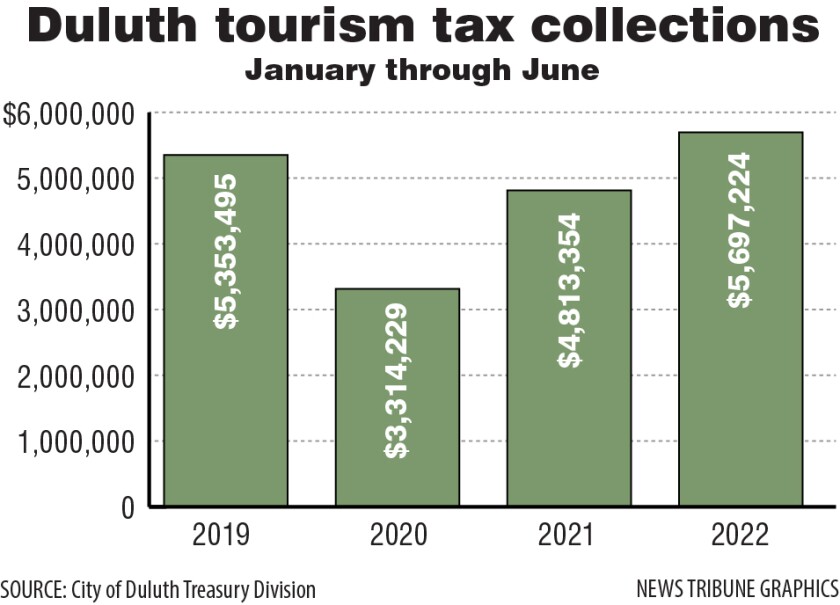

Duluth Tourism Revenues Rebound To Pre Pandemic Levels Duluth News Tribune News Weather And Sports From Duluth Minnesota

Duluth S Tourism Tax Collection Rebounds To Pre Pandemic Levels

Matchbook Karsbar Liquors Restaurant Duluth Mn Full Ebay

Duluth Tourism Revenues Rebound To Pre Pandemic Levels Duluth News Tribune News Weather And Sports From Duluth Minnesota

Sit Down Dinners Dry Dock Duluth

Qualifying For State Aid A Headache For Duluth Restaurants Duluth News Tribune News Weather And Sports From Duluth Minnesota

Huge Vintage Restaurant Menu Somebody S House Bloomington Duluth Minnesota Mn 1842540064

It S All Starting To Snowball Decc Worries About Umd Lease Amsoil Bonds Duluth Monitor

Huge Vintage Restaurant Menu Somebody S House Bloomington Duluth Minnesota Mn 1842540064